37+ How To Surrender Lic Policy After 10 Years

Total amt paid by him was. 1030 X 30 lac Bonus LIC surrender Factor NoteOnce you submit the all necessary documents then wait for 5-10 days they transfer the fund to your bank account.

Poor Returns In Life Insurance To Surrender Or To Exit

Surrendered the policy immediately after 10 yrs.

How to surrender lic policy after 10 years. Under Single Premium Plan. A policyholder must follow the below key points for LIC Policy surrender. Assuming the surrender value after 10 years would be approx.

The usual minimum period to surrender LIC policy in normal scenario is as follows. This surrender value depends on the sum assured bonuses policy term and premiums paid. The policy can be surrendered from the 4th year onwards.

Now suppose a person wants to surrender their LIC policy before the completion of 3 years because of underlying reasons. I have experienced that only the branch from where the policy was bought is to be visited for this purpose s no other branch will entertain this request. Original policy bond document.

Go to any nearby LIC branch to get a copy of the application. Surrender After 10 Years. Because now LIC issue the payment directly to.

On the application provide your policy number identifying information and bank information so the surrender value can be transferred to your account. Complete an application for surrender value. Now Having paid for 10 years Mr A wants to surrender it.

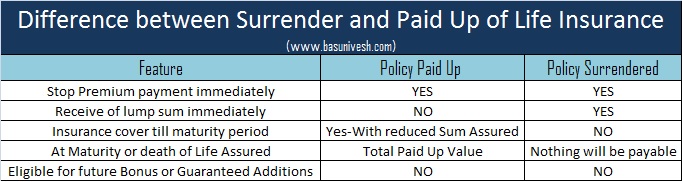

A policyholder can surrender hisher policy only after the completion of 3 years ie. Surrender of life insurance policy is an option to terminate the life insurance product before maturity and by opting so the policyholder will get an amount commonly known as Surrender Value. The surrender value provided by LIC is essentially 30 of the premiums that have been paid so far.

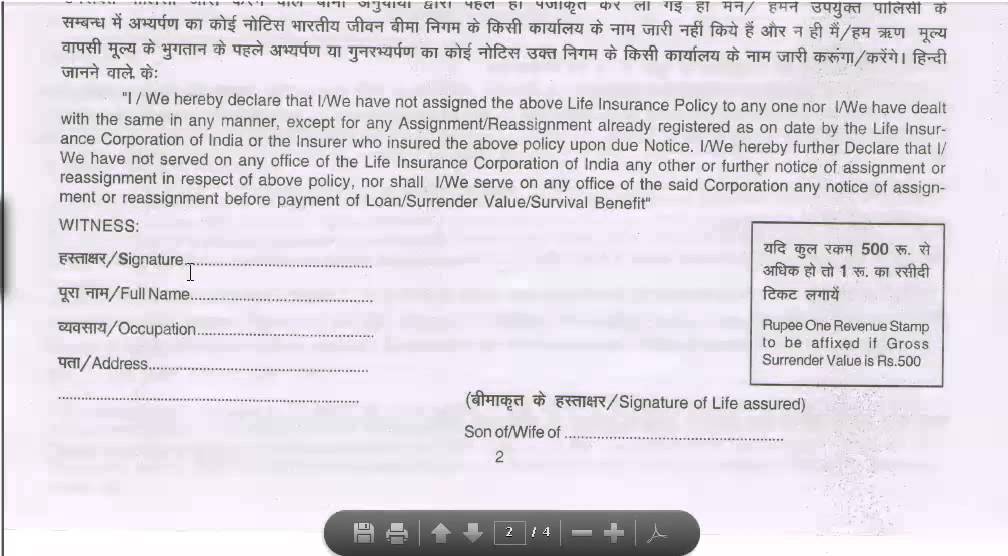

Visit the LIC Branch Office with the Policy bond. The most appropriate way to purge such LIC policies is to surrender them. To surrender a LIC policy the policyholder must take the following steps The policyholder should visit the nearest branch of LIC and avail a surrender discharge voucher.

You must fill out and submit the paper application. However this will exclude premiums that were paid during the first year of the policy. The same varies with age term health and such other underwritting considerations.

LICs NEFT Form if you are not using the above said Surrender Form. Vested Bonus after 10 Years Approx. The form should be filled and submitted with the relevant documents.

The surrendered value will become zero as earlier said that the surrendered value is applicable only after three full years of premiums paid. Documents Required for Surrender LIC Policy. Take the printout and go with this form.

In case of longer tenures of 10 years and up the minimum duration is 3 years. Form No-5074 should be filled. Premium paid in 10 Years Rs.

Special surrender value 10 00000X420 50000 X50 INR 1 25000. LIC Policy Surrender Form No5074Form can be downloaded. With the steps mentioned above you can easily calculate the surrender value of your LIC policy.

The formats keep on changing so it is better to ask the form from the branch. B Special surrender value. How to surrender LIC policy.

If the policy term is 10 years or below the duration is two years. The Surrender Discharge Voucher is called Form 5074. Download LIC Policy Surrender Form No5074.

Suppose Mr A has take a policy of rs 30 Lac for 30 years terms. This type of discontinued policy is called paid-up policy. A person paid for 10 yrs at the rate of 72000 per annum.

How to Surrender LIC Policy. The choice of surrendering your LIC policy mid-way gives you the freedom of investing in any other LIC policy without the worries of the future. Now should you surrender this policy and take a loss of Rs.

The policy has to have been in force for a period of 3 years at least. A LIC policyholder should collect from the nearest LIC branch the Form No- 5074 ie. Surrender can be done from the third policy year.

Bank cancelled cheque leaf your name should be printed on cheque or bank passbook photocopy. The policy can be surrendered after it has been in force for at least 3 full years. Surrender of policy can never be made in the first year of policy purchase.

If the PPT is less than 10 years even if the actual policy term is 25 30 years the policy will acquire a surrender value if the premium has been paid for at least two years. Documents Required to Surrender LIC Policy. If you have traditionalpolicy with term more than 10 years than you may have to visit LIc office to get Surrender Value or you can Calculate on your own as per formula given in Policy document.

575 of premiums paid -Rs. Under Limited Period And Regular Premium Plan. Bro Im giving you live example.

Application for Surrender Discounted value. The Guaranteed Surrender value will be equal to 30 of the total amount of premiums paid excluding the premiums for the first year and all the extra premiums and premiums for accident benefit term rider. His claim was settled for 1030000.

It can be calculated by using the following formula. This live example is for a person aged 28 yrs. If you have ULIPUnit linked Insurance Plan bought after 2012 will have 5 years of Lock in period and you can withdraw Full amount after 5 years by paying surrender changes if any.

If you plan to surrender your endowment policy bear in mind all the money you have paid that you may never get. Surrender value after 10 years Approx. Ask for the surrender form or you may Download-LIC-Policy-Surrender-Form-No5074 form from here.

Under this plan policy can be surrendered in the second year of purchase. For single premium policies the surrender value gets acquired after the first year itself. Special surrender value Paid-up value bonus x Surrender value factor Surrender value factor is a percentage of paid-up value plus bonus.

Lic New Plans List 2018 19 Features Review Snapshot Of All The Plans Credit Card App How To Plan Types Of Planning

Easy Ways To Close An Lic Policy Before Maturity 9 Steps

Lic Jeevan Lakhshya Plan How To Plan Retirement Planning Policies

How To Surrender Lic Policy And How To Download Surrender Form Youtube

How To Surrender Lic Policy After 3 Years Or Before Maturity Basunivesh

Lic Policy Services Information How To Surrender Lic Policy And How To Fill Lic Surrender Form Youtube

Easy Ways To Close An Lic Policy Before Maturity 9 Steps

Life Insurance Of India Lic Of India Lic Jeevan Labh Plan Table No 836 Maturi Life Insurance Marketing Ideas Life Insurance Facts Life And Health Insurance

Easy Ways To Close An Lic Policy Before Maturity 9 Steps

How To Surrender Lic Policy Youtube

Belum ada Komentar untuk "37+ How To Surrender Lic Policy After 10 Years"

Posting Komentar